are funeral expenses tax deductible in california

No never can funeral expenses be claimed on taxes as a deduction. This cost is only tax-deductible when paid for by an estate.

Qualified medical expenses must be used to prevent or treat a medical illness or condition.

. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. Can I deduct funeral expenses probate fees or fees to administer the estate. While these events are a good way to gather family and friends to honor the deceased funerals can be.

Appeared first on SmartAsset Blog. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Expenses that exceed 75 of your federal AGI.

These are personal expenses and cannot be deducted. The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions. A couple of funeral expenses are not eligible for tax deductions.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. If theyre paid for by friends family or even the departed individuals account they will not be deductible no individual deductions are. Appeared first on SmartAsset Blog.

Estates however are able to deduct funeral costs from taxes. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. When a loved one passes away most families hold a funeral to mourn remember the deceaseds life and pay last respects.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. This may include the costs of hiring a funeral director embalming and preparation fees and internment of the body. But this isnt applicable to every estate.

This is only applicable to estates that pay taxes and in order for an estate to be required to pay taxes it must have a minimum gross value of 1158 million. The IRS deducts qualified medical expenses. Expenses that exceed 75 of your federal AGI.

Can funeral expenses be deducted Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Individual taxpayers cannot deduct funeral expenses on their tax return. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

If you dont know who regulates the cemetery youre interested in ask the cemetery manager If you need help with a cemetery or funeral issue visit the Bureaus Web site at wwwcfbcagov or call the Department of Consumer Affairs Consumer Information Center at 800 952-5210 or the Bureau at 916 574-7870. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

In short these expenses are not eligible to be claimed on a 1040 tax form. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

Expenses that exceed 75 of your federal AGI. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. Job Expenses and Certain Miscellaneous Itemized Deductions.

On home purchases up to 1000000. Deduction CA allowable amount Federal allowable amount. Continue reading The post Are Funeral Expenses Tax Deductible.

According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. Qualified medical expenses include. So a 25 souvenir death DVD would no longer cost 25 but 2706.

While the irs allows deductions for medical expenses funeral costs are not included. California law requires you to file the death certificate with the local registrar of births and deaths within eight calendar days of the death and before you dispose of the remains. State and local taxes real estate tax mortgage interest and charitable contributions.

This means that you cannot deduct the cost of a funeral from your individual tax returns. In other words funeral expenses are tax deductible if they are covered by an estate. The taxes are not deductible as an individual only as an estate.

When a loved one passes away most families hold a funeral to mourn remember the deceaseds life and pay last respects. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. California Health Safety Code 102775 2018.

Funeral expenses are not tax deductible because they are not qualified medical expenses. Any travel expenses incurred by family members of the deceased are not deductible. Funeral expenses are not tax-deductible.

While the IRS allows deductions for medical expenses funeral costs are not included. Funeral Costs Paid by the Estate Are Tax Deductible. The state gets to collect sales tax on such personal property.

Medical and dental expenses. Continue reading The post Are Funeral Expenses Tax Deductible. Deductible medical expenses may include but are not limited to the following.

Up to 25 cash back If you will not be using a funeral director you must complete and file the death certificate yourself. They are never deductible if they are paid by an individual taxpayer. Individual taxpayers cannot deduct funeral expenses on their tax return.

If the deceaseds state is. Any individual even the ones who personally paid out-of-pocket will not be able to claim funeral expenses on his or her taxes. Rules for Claiming Funeral Expense Tax Deductions.

While the IRS allows deductions for medical expenses funeral costs are not included. Funeral expenses are not tax deductible because they are not qualified medical expenses. While these events are a good way to gather family and friends to honor the deceased funerals can be.

When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs. Not all estates are large enough to qualify to be taxed. On home purchases up to 750000.

Individual taxpayers cannot deduct funeral expenses on their tax return. Individual taxpayers cannot deduct funeral expenses on their tax return. Who reports a death benefit that an employer pays.

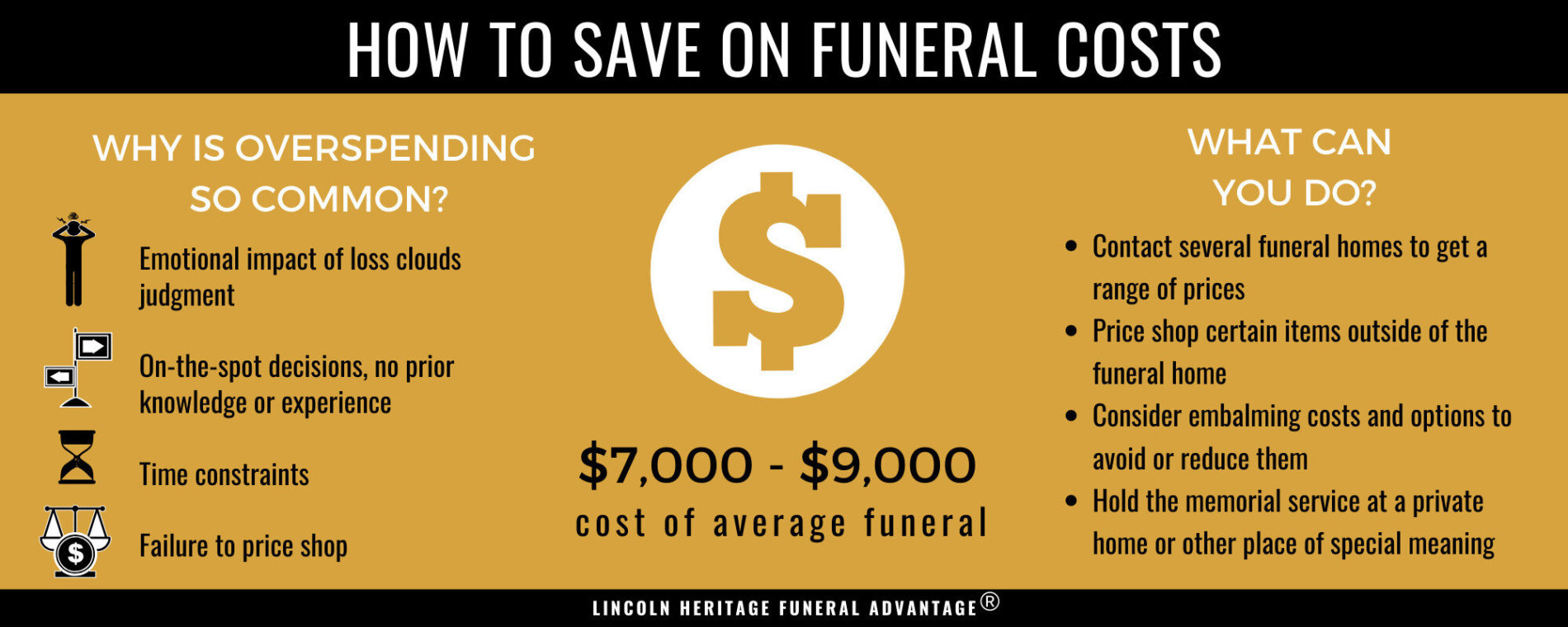

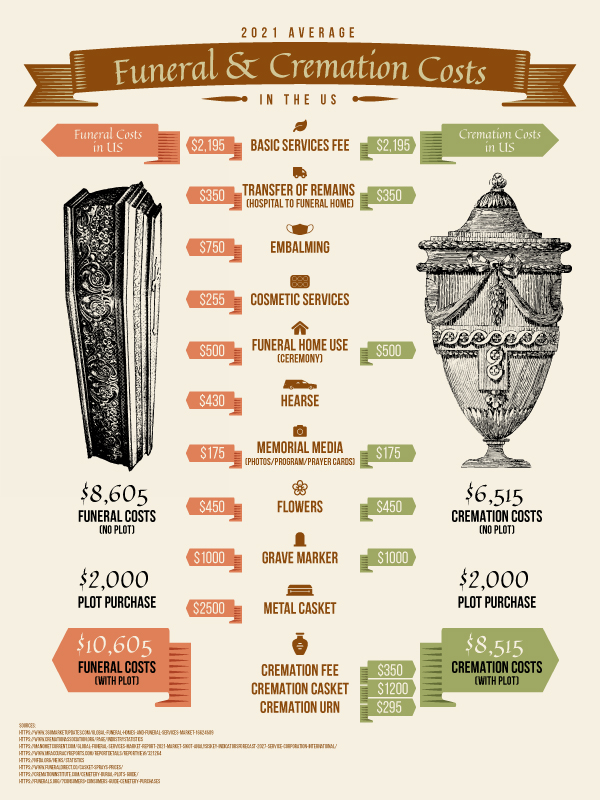

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

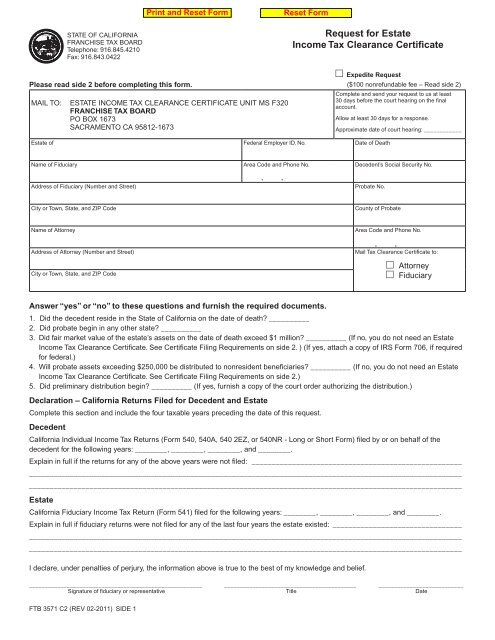

Ftb 3571 Request For Estate Income Tax Clearance Certificate

California Funeral Burial Insurance Costs Faqs Lincoln Heritage

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible

California Funeral Burial Insurance Costs Faqs Lincoln Heritage

Pin On Editable Online Form Templates

California Decedent Estate Practice Legal Resources Ceb Ceb

Ca 2022 2023 Budget Ends Nol Deductions Business Credits Suspensions